Selling Property With A Defective Title

There can be some challenges involved with trying to sell a home that has a defective title, but you’re also able to take certain steps that make it easier to attract a fair and quick offer.

Call 020 7183 3022 for your FREE sale price estimate

Your top questions when selling property with a defective title

What does it mean when my property has a defective title?

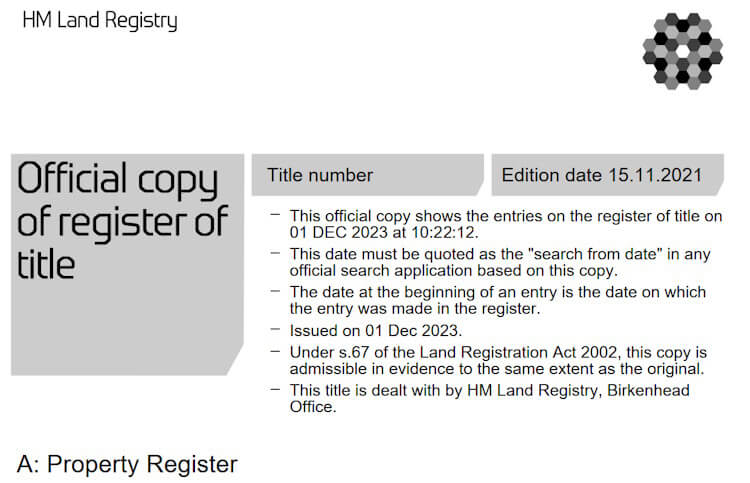

Since December 1990, homes in England and Wales have had to be registered with HM Land Registry, which gives properties a unique title number and notes that you are the legal owner of the house or flat and have the right to sell it. But the title can be considered defective if it is missing some information or has irregularities, and this can complicate the selling process.

✅ What are some examples for when a home may have a defective title?

Some of the most common situations where a property is deemed to have a defective title include when no agreement exists over the maintenance or repair for a road or sewer on the property, where there isn’t a right of way for a footpath, track, road or other property access, where restrictive covenants exist that could be breached, and other scenarios.

✅ Why might buyers be wary about properties with a defective title?

When someone is looking to purchase a home and they see that yours has a defective title, they could have concerns about whatever problems exist with the title, for example if there are issues over the right of way for an access to the home. Buyers could worry that the potential future complications involved may be stressful and this can cause them to lose interest.

✅ Should I get indemnity insurance when selling a home with a defective title?

Purchasing indemnity insurance can be one way to cover yourself against liability for problems that the next owner of your home might face as a result of defects in the title for the property. But this could be expensive and time-consuming, and you are not required by law to get insurance before selling – and some buyers will make offers even without such insurance.

✅ How quickly will I be able to sell a defective title house or flat?

If you opt for selling your home using LDN Properties or another quick buyer then it should only take a few short weeks to complete the entire process, including the exchange of contracts and you receiving the full proceeds. By contrast, it could take many months at least to find a buyer when you choose to sell on your own, with an estate agent or at a property auction.

✅ How much commission will I pay when selling a home with a defective title?

It depends on which option you use to find a buyer for your property because you will not have to pay any commission if you choose to sell either without any assistance or to a no-fee quick buyer such as LDN Properties. But if you sell your home through an estate agent or auctioneer then you will have to pay them commission that will be deducted from the final sale proceeds.

✅ How do I know to trust a quick buyer with the sale of my defective title property?

You should ask specific quick buyers if they can prove they are members of The Property Ombudsman (TPO), which is an independent organisation that writes rules to shield owners from fraud in the quick buying industry. Never sell your house or flat to a company that cannot prove it belong to TPO, because it won’t have to follow those rules and could be a scam.

Latest guides

We’re rated as Excellent

Reviews.co.uk provide independent reviews from other people just like you!

"Successfully sold two properties direct to LDN Properties in the last two years. Genuine and trustworthy people and the dealings were straightforward." – Thomas from London

LDN Properties Limited, Linen Hall, 162 Regent St. London W1B 5TD

Company No. 04636129. ICO No. Z7733416. Ombudsman No. D12463.

Copyright 2003 to 2024