Selling Flat Without TA7 Form

You might find that there are some additional challenges involved with trying to sell a leasehold flat when you try to find a buyer without completing a Leasehold Information Form, or TA7 form.

Call 020 7183 3022 for your FREE sale price estimate

Your top questions when selling a flat without TA7 form

✅ What does it mean to have a TA7 form for my leasehold flat?

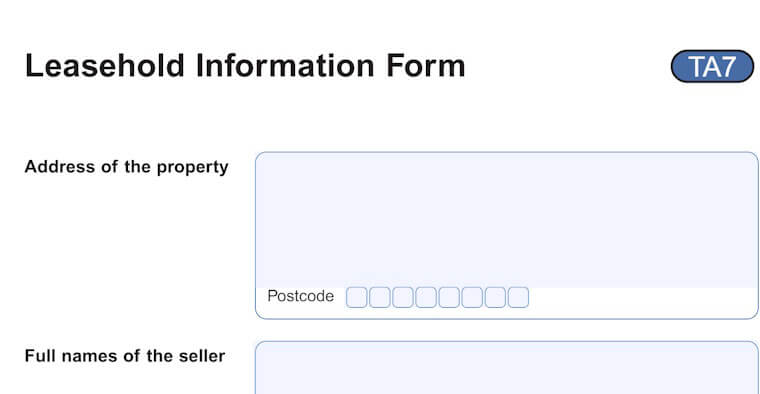

Officially known as a Leasehold Information Form, but more commonly as a TA7 form, this is one of several documents involved with the sale of a leasehold flat. In particular, the TA7 form is one where the seller of a property provides an extensive amount of information about the home, but it is still possible to sell your flat even if you opt against filling out this form.

✅ What specific information would a TA7 form for my flat have to include?

One version of The Law Society’s TA7 form runs to 12 pages and it includes dozens of questions about many varied aspects of your leasehold flat. But some of the sections that will get the most attention from potential buyers include those asking about any structural damage or alterations to the flat, legal notices and disputes, and service charges at the property.

✅ Can I withhold certain information about my flat on the TA7 form?

If you decide to fill out a TA7 form before attempting to sell your flat, you might be tempted to withhold certain information that you think buyers will view negatively, because you could worry that this will make them lose interest in your property. But if they buy a flat and later discover these issues, the buyer can sue you and it might result in expensive legal fees for you.

✅ Are there any difficulties with selling a flat that doesn't have a TA7 form?

There might be some extra challenges with selling a flat without completing a TA7 form, including the fact that certain buyers might worry that you are trying to conceal a significant problem with the home that they will only discover after they buy it and move in. For this same reason, mortgage lenders may be wary about approving loans for someone to buy your flat.

✅ What are the options to find a buyer for a flat without a TA7 form?

You can choose from selling your flat to a quick home buying company such as LDN Properties, selling through an auctioneer, selling with an estate agent or selling without any help. All four of these methods have their own pros and cons, such as the benefit of quick buyers not charging any commission and the drawback of selling on your own possibly taking more than a year.

✅ If I don't have a TA7 form, how quickly will I be able to sell my flat?

This will depend on which method you select for selling the property, because it might take more than a year to find a buyer and complete the sale when you use an estate agent or you sell without any assistance, whereas selling at an auction can take many months at least. Selling to a quick buyer should only take a few weeks, and that includes the exchange of contracts.

✅ Will I be required to pay commission when selling a flat with no TA7 form?

Not if you choose to sell to a zero-commission quick home buying company like LDN Properties, or if you sell without the help of a fee-charging third-party, so either option can help with reducing your overall expenses when selling. But if you sell via an estate agent or an auctioneer then they will charge you commission and this will be deducted from the final sale proceeds.

Latest guides

We’re rated as Excellent

Reviews.co.uk provide independent reviews from other people just like you!

"Successfully sold two properties direct to LDN Properties in the last two years. Genuine and trustworthy people and the dealings were straightforward." – Thomas from London

LDN Properties Limited, Linen Hall, 162 Regent St. London W1B 5TD

Company No. 04636129. ICO No. Z7733416. Ombudsman No. D12463.

Copyright 2003 to 2024