Selling a Probate Property

Selling a probate property isn’t always as straightforward as other property sales – there is additional legal work required by the vendor (executor). Find out about selling directly to us.

Call 020 7183 3022 for your FREE sale price estimate

- LDN Properties

- House Sale Situations

- Selling a probate property

Quick navigation

When you’re considering "selling a probate property", we have prepared you a useful guide covering some of the key stages of the process. Our professional team is available to discuss the sale of your probate house and answer any questions you may have.

- General information regarding probate

- Hiring a probate solicitor

- Complications when selling a probate house

- The cost of inherited properties

- Time frame for a probate sale

- Selling probate property from the buyer perspective

- Steps to selling a property under probate

- Tips for selling an inherited property

- Questions you may have regarding probate

General information regarding probate

Probate is simply the catch-all term for the legal management of a deceased person’s possessions – see The Gazette Probate Checklist. When someone passes away, their estate (made up of money, shares, possessions and property) is usually divided between the deceased individual’s family as per the requests of their will. Alternatively, if no will has been left behind (known as intestacy), the estate is left to family members in a pre-established order. For those inheriting their loved one’s property, maintaining it can be a financial, physical and emotional burden. Understandably, many prefer to sell rather than keep these properties in a process known as a "probate sale". This may also be necessary in order to fairly divide the deceased’s assets among the relevant beneficiaries.

It’s a confusing and often overwhelming topic, but you needn’t face it alone. There’s guidance to be found online and in-person, including this guide we’ve prepared for you here as well as a probate video published by Which that is a recommended watch. We are familiar with the issues that can arise when you sell a probate property and can offer a reliable sale with no fees and no commission. We’re here to support you and ensure you’re able to make an informed choice for the benefit of you, your loved one’s estate and all of its beneficiaries.

Hiring a probate solicitor

If the will designates an executor (otherwise known as a personal representative), this person (if they agree to the responsibility) will be responsible for gathering and distributing the deceased individual’s estate including selling property. It’s worth noting that the designated executor can decline the responsibility, and professionals – known as probate solicitors can be hired to carry out the probate process instead. Hiring a professional can be a smart choice if the estate is particularly complex. If, for example, the estate includes foreign property, there are potential disputes between the beneficiaries or the estate is bankrupt. As is to be expected, a probate solicitor will require payment for their service and is typically a percentage of the estate’s proceeds. For this reason, it can be advisable for the executor to carry out probate themselves and save money if the estate is relatively free of complications.

Complications when selling a probate house

Most properties in the UK are sold through estate agents, but the difference with probate property sales is that there can often be issues raising finance for the average buyer. Reasons for this can be because probate properties are often in need of modernisation or retirement homes, paperwork is sometimes not available and protocol forms cannot be completed accurately. Some of these issues only come to light later in the sale process and can often result in a mortgage application being rejected and a house sale falling through, meaning the sale has to start from scratch. Meanwhile the vendor has to maintain an unoccupied property and wait for a new buyer.

Sellers may struggle with probate sales too. For a myriad of reasons, houses sold under probate can be more difficult, time-consuming and complicated than houses sold under typical circumstances. Obtaining a grant of probate, identifying any unknown creditors and settling any disputes among beneficiaries are among the requirements and issues executors may face through the probate process.

The cost of inherited properties

Even assuming you don’t enlist the help of a probate solicitor or similar professional, selling an inherited property and maintaining it during the probate process will inevitably result in costs for you. The exact figure, however, depends on several variables. The estate will be subject to inheritance tax if it’s valued over £325,000 and Capital Gains Tax if it sells over the official valuation figure (please check the Government website for latest information on thresholds as these can change). Additionally, you will also need to keep up with any mortgage payments, bills and insurances related to the property and estate throughout the probate process. Several one-off payments including repairs, house clearing services and the process of acquiring an Energy Performance Certificate (EPC) will also need to be made which, while not likely to compare in size to earlier figures, can certainly add up.

Any debt owed by the deceased individual at the time of death will be taken out of the estate’s total value. If the estate’s value doesn’t cover the total debt, the sums will need to be prioritised in a strict, law-defined order with mortgages and funeral costs coming first. No beneficiary will inherit any of this debt unless they have entered into a credit agreement with the person prior to their passing.

Of course, the executor will also face regular estate agent fees (between 1.5-3% + VAT of the property’s final sale price) if indeed they decide to sell this way and conveyancing fees should they sell via a high street estate agent.

Time frame for a probate sale

As for the length of time probate takes, it will generally depend upon the size of the estate. The starting point is to value the deceased’s assets and liabilities. Thereafter, the inheritance tax returns can be completed and the application to the probate registry made. Once the grant is issued the various assets can then be collected, and the estate distributed. For estates involving inheritance tax, usually where a property is included in the estate it can take anywhere between 4-12 months. Those cases where the Estate is under the inheritance tax threshold are often much quicker to conclude and typically can take anything from 2-6 months.

If the burden of selling an inherited property is too troublesome, and you’re in need of a quicker house sale, we can provide a quick, simple and reliable solution to selling your property. We’re happy to provide help with the legal paperwork and can buy your property directly without much of the hassle involved with the estate agent route.

Selling probate property from the buyer perspective

As the seller of an inherited property, it is important to consider the steps the buyer will be going through and how these may be different to the typical process of buying a house. This is important as you may be able to help smooth the path to a speedier sale with less troubles along the way.

Potential for unknown issues – As the seller / executor of a probate property you will not have intimate knowledge of the house that the original owner did. In some cases (if the beneficiaries have enlisted a probate solicitor) there may be no personal relationship with the house at all. For this reason, you may find any buyer looking to have a number of inspections of the house during the conveyancing process to mitigate the risks they are facing.

Grant of probate delays – Another potential bump in the road of probate property sales arises if the seller has yet to receive a grant of probate. As inherited properties can be listed on the property market before the seller has the right to finalise any sales, it’s possible that the buyer may be forced to wait for months until the seller has a grant of probate, even if both parties are fully prepared to go ahead with the sale. This may need careful management with the buyer to make sure you don’t lose their interest in buying the property.

Steps to selling a property under probate

In the following section, we’ll lay out the probate sale path and walk you through its various stages. No matter how you choose to approach the probate process, it’s vital that you’re informed and confident with how you choose to handle your loved one’s estate.

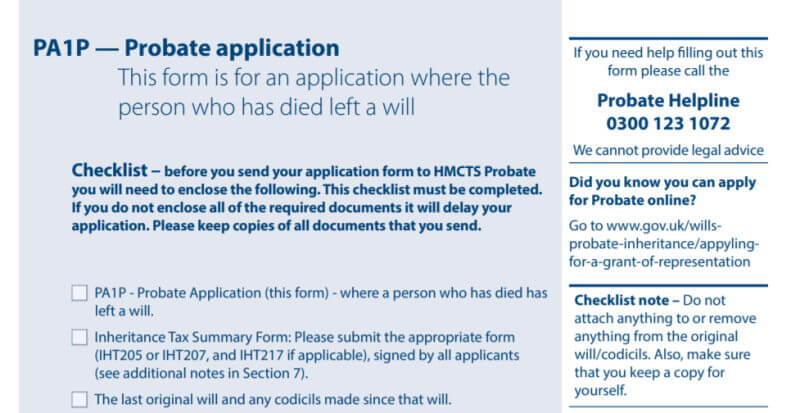

Applying for probate

The first step in selling a property under probate should be to apply for a grant of probate. This grants you, as the executor, permission from the probate court to handle all of the assets of the deceased’s estate. While you are able to line up and begin the real estate process without this, no sale can be finalised without a grant of probate.

On the government website, you’ll need to locate and fill in both an Inheritance Tax form and a probate application form to begin the probate grant application. The latter has two variants, PA1P and PA1A; the one you need to fill in will depend on whether the deceased individual has left a will or not. If there is no will, you’ll actually be applying for a "Grant of Letters of Administration", not a grant of probate, although they serve the same function. Additionally, you’ll need to provide the probate court with the original will (plus 2 copies) and the death certificate (or an interim death certificate from the coroner).

With all appropriate documents gathered and filled in, you’ll then need to send them to your local Probate Registry. A short while afterwards, they’ll help you arrange an in-person appointment to swear a probate-proving oath. Roughly 10 working days after you swear the oath, the grant of probate should be yours. The whole process, if inheritance tax is due, can take around 3 months.

Value the property

Next, you’ll need to accurately value the property for probate purposes. For inheritance tax reasons, it’s important that the value pertains to the property at the time of its previous owner’s death. As property values are prone to fluctuations, it can be helpful to hire the services of a valuer with local expertise. On top of this, an RICS (Royal Institute of Chartered Surveyors) qualified surveyor, as opposed to an estate agent, will more accurately value a property for probate purposes.

If HMRC suspects that the property has been improperly valued, you will be forced to cover any underpaid inheritance tax. While an estate agent will value your property free of charge, you’ll need to receive multiple valuations to arrive at an accurate figure. With a RICS surveyor, one estimate should suffice as valid for HMRC.

Paying inheritance tax (IHT)

Unfortunately, inheritance tax must be paid (at a rate of 40%) on the estate’s value over a £325,000 threshold. This means that if the estate is worth £500,000, you’ll pay 40% tax (£70,000) on the £175,000 threshold-exceeding figure. Please check latest tax rates and thresholds on the UK Government website. Inheritance tax is handled by the executor before the beneficiaries receive their entitlements and must be paid no later than 6 months after the person’s death.

To pay the inheritance tax, you’ll need to contact HM Revenue and Customs (HMRC) and request a payment reference number. Following this, you can pay the tax via your bank account, the deceased’s account or a joint account opened specifically to handle probate.

Informing the relevant parties

Any organisation or company with a legal or financial relationship with the deceased person must be informed of their passing. Local councils, utility providers, banks, creditors and insurance companies are all included on this list but there will likely be more; it all depends on the individual’s unique circumstances as the time of death.

It’s also advisable to reach out to any unknown beneficiaries via an advertisement in the Gazette, an official public record. Once an advertisement has been placed, beneficiaries have 2 months to come forward; after that, the executor is not liable for inadvertent mis-distribution of the deceased’s estate.

Preparing the property for sale

Emptying the property can be an emotionally charged process, rifling through a loved one’s belongings and throwing out possessions can be particularly difficult so soon after their passing. It may be useful to enlist the help of a third party valuer to help determine the objects of value among the deceased’s possessions.

Especially if selling the property via an estate agent, investing time and a sensible amount of money into making the house presentable can help speed up the house-selling process. Don’t get carried away however, as doing-up a house too much will also increase its value far beyond the figure declared at the time-of-death valuation. While this sounds like a positive, it means you will also owe more Capital Gains Tax. The exact figure owed can be tricky to figure out, although HMRC offers a calculator for exactly this purpose.

Listing and selling the property

There are multiple ways of approaching the process of selling a probate property, each with their own sets of advantages and disadvantages.

High street estate agents can assist with a lot of the legal work and complications associated with selling a house, taking some responsibility off your hands in this already stressful time. They can also leverage local knowledge to help sell the property at the highest price possible. However, they don’t offer the fastest method of selling a property, and if the inherited house isn’t particularly desirable (as is the case for many inherited homes) you can be faced with months upon months of recurring bills and payments while struggling to find a buyer. High street estate agents charge commission on the final sale price of the house (between 1.5-3% of the final sale price plus VAT), which leaves less for you and the estate’s beneficiaries.

Online estate agents leave more of the work (and accompanying stress) in your hands, but they charge a flat rate instead of working on commission. Especially for high-value properties, this can work out much cheaper, leaving more funds to divide among the beneficiaries and cover the deceased’s outstanding debts. Do be sure that you’re equipped to take on the increased pressure that comes with eschewing the support of a high street estate agent. With the pressures of managing a loved one’s death and the legal minefield of probate, handling every facet of a house sale might prove too much.

While estate agents are well-versed in current and local housing trends, probate properties tend to be dated, unattractive and even in some degree of disrepair as a reflection of the elderly residents who once occupied them and their lack of concern for their property’s market value. For this reason, many properties would benefit from selling at auction rather than with an estate agency. Probate property sales are incredibly appealing to the "buy cheap and do-up" sector of the housing market who frequent housing auctions. Not only can a house in poor condition sell quicker at auction—without the lengthy preamble of house viewings and estate agency paperwork—but it also stands to sell for more than with an estate agent who’s used to marketing more instantly attractive properties.

Alternatively, as a reliable direct property buyer, LDN Properties is well-equipped to buy your probate property professionally, hassle-free and to a timescale that suits you. For many executors selling a probate house, speed is the key factor in choosing a house-selling method. LDN Properties offers a speed of service that is unmatched by property auctions, estate agents or online house-selling solutions. Plus, you’ll receive a cash payment.

Paying capital gains tax

If your property sold for more than the figure determined at the time-of-death valuation, you will owe Capital Gains Tax. As mentioned earlier, the exact figure owed is complicated to figure out and is affected by your income tax rate as well as any costs involved in selling the property. That’s why HMRC’s Capital Gains Tax calculator exists; it can help you figure out exactly how much you owe after selling your property.

It’s worth noting that there is also a Capital Gains tax-free allowance of £12,300 per year. If you’ve owed no additional Capital Gains Tax in the financial year in which the probate sale has occurred, you’ll be exempt from the first £12,300 earned over the initial time-of-death valuation.

Tips for selling an inherited property

Guidance regarding wills, probate and inheritance can be found on the official UK Government website. The website provides a step-by-step guide to the process of dealing with selling a probate property. Whether you need help with the standard protocol of a probate sale or are dealing with unusual circumstances unique to your situation, the government website can provide some level of support.

Making your property look presentable, clean and tidy will dramatically increase the chances of a quick sale—especially if selling via an estate agent. Don’t be afraid to get your hands dirty scrubbing skirting boards, tending the garden and generally decluttering – especially if it was a hoarder’s property.

A good RICS qualified surveyor should be able to provide guidance on the best method of sale, any improvements which may help during the house sale preparations and what the ideal next steps should be for you as the executor. It’s well worth listening to this as every housing situation is different, and no generic advice can compare to the guidance of a professional acting on the knowledge gained assessing your property first-hand.

Keeping clear records of every legal action taken and choice made during the probate process will prevent any unexpected consequences in the future. Beneficiaries, courts or organisations may request any number of these documents, and it could save you a great deal of stress to have them all gathered, filed and ready to retrieve.

We have put together a short video guide of things to consider before you sell a probate property and the duties of the executor.

Questions you may have regarding probate

We have answered many commons questions regarding the various stages of the probate process and we would advise you also the read the numerous "Wills and Probate" articles at The Gazette website

✅ What is probate and how do I approach dealing with it?

Probate is the process (both legal and financial) of dealing with the estate of someone who has died. This typically means clearing their outstanding debts and then distributing their remaining assets in accordance with the stipulations of their will (or indeed intestacy rules when a will is not present).

✅ As an executor do I need to wait for probate before selling the deceased's property?

Assuming the property was owned in the deceased’ sole name, you would be required to obtain a grant of probate before the property sale can actually be completed and is essential step that must not be overlooked. The grant of probate proves the rights of the executors who are named in the deceased’s will. You can discuss the sale of the property and obtain valuations before the grant has been obtained. This is where you may find it useful to have an initial discussion with LDN Properties and request an offer from us. As professional property buyers we are happy to discuss your property sale further and are happy to purchase houses and flats in all stats of repair. Speak with our team on 020 7183 3022.

✅ Do I need to instruct a solicitor for probate?

It isn’t a necessity to instruct a solicitor for probate. The executors themselves are able to make applications for probate and indeed for smaller and straightforward estates, this may be an appropriate route to take. However, people typically choose to have initial discussions with solicitors to understand further details of the probate process, thus enabling them to make an informed decision at what can be quite a stressful time.

✅ Should I pass executor duties to a solicitor?

For minor estates, especially those without the likelihood of disputes among beneficiaries, a probate solicitor may not be necessary. However, there are an overwhelming number of ways in which managing an estate can become a legal minefield; for these circumstances a solicitor would be of great benefit. For example, if the deceased owned out-of-country property or assets; one or more of the beneficiaries is under 18; or if the deceased was a business owner, a solicitor’s services would greatly simplify matters for you.

✅ What documents do I need to apply for a grant of probate?

Indeed, there are several documents you’ll need to supply in order to apply for a grant of probate. Locating them all may present a challenge. It’s one of the reasons many people turn to probate solicitors at this time; they can help track down and collate all of the necessary documents. In addition to the inheritance tax form and PA1 forms, you’ll need:

- Bank and/or building society statements/accounts

- Bills or outstanding debts

- Credit card statements

- Death certificate

- Funeral expenses

- ID

- Information on owned shares and savings

- Mortgage details (if applicable)

- National Insurance number of the deceased person

- Original will (plus copies)

- Pension due/received (if applicable)

- Property Deeds

✅ What if there are unpaid mortgages on my probate property?

Just like any other debt owed by the deceased individual at the time of death, the mortgage will be paid from the proceeds of the estate. If the debt cannot be fully paid by the estate’s total value, the debts are prioritised according to a set order (with mortgages and funeral expenses coming first) and any outstanding debt will sometimes be waived. If, however, the deceased person entered into a joint credit agreement prior to death, that specific debt would transfer to the other party/parties involved.

✅ What's the best method of selling a probate property?

With all the legalities of probate sorted, the question of how best to actually sell your property comes next. Unfortunately, there isn’t a "one size fits all" answer; the best method of selling a probate property depends on the specifics of the property, your circumstances and your personal requirements.

Presentable probate properties – well-looked after or modern ones – fare well when sold via high street estate agents or online. When viewed in-person, these houses make a good impression on prospective buyers, and the lack of a chain (meaning you, as the seller, are not looking to move out of the property into a new one) is appealing too. However, the estate agent process can be lengthy, even more so if the property is unstylish, dated or in poor condition. If you’re in a hurry to dispose of your probate property, estate agency may not be for you.

Alternatively, housing auctions are quicker and suit harder-to-sell properties far better than the estate agent method. With an auction room of keen buyers, this can offset any potential for a house auction to result in a lower sale price (not that it always will).

Residential house buyers like us can often be a good method of disposing of a property if speed and convenience are the key factors. Not only do we offer fair cash sums for your property, but we’ll provide an offer free of charge and can handle the entire process at a speed that suits you. Unlike estate agents, we charge no fees and you won’t be forced through the process of hunting for a buyer. At a time of great personal stress, ease and convenience couldn’t be more important to you; that’s what we offer at LDN Properties.

If you have any questions regarding selling your probate property, the team at LDN Properties are happy to help and provide you with an indicative offer – 020 7183 3022.

See what we can offer?

Let us show you what we can pay for your house

We’re rated as Excellent

Reviews.co.uk provide independent reviews from other people just like you!

"Successfully sold two properties direct to LDN Properties in the last two years. Genuine and trustworthy people and the dealings were straightforward." – Thomas from London

Cash offer for your house

LDN Properties Limited, Linen Hall, 162 Regent St. London W1B 5TD

Company No. 04636129. ICO No. Z7733416. Ombudsman No. D12463.

Copyright 2003 to 2024